CONTENTS

1. Introduction

In 2019, the US imported a total of $588 billion in services (ref US Census). An important part of them can be provided remotely using information and communication technologies, such as financial services, insurance, research and development, consulting, engineering, training, design and sale of intellectual property.

The USA is the largest importer of services in the world (10% of the global total, (ref CRS) and one of the most open developed economies

We already discussed in a recent post that COVID-19 has created barriers to the flow of human capital but also interesting business opportunities. Various aspects of the crisis will further boost the import of some remote services. Key factors are the increase in demand in sectors such as technology or health, travel restrictions and the temporary suspension imposed on immigration, the massive acceptance of remote work and online services, and the lower impact expected on the US economy as compared to the EU and other economic powers.

In this article we will analyze the existing opportunities, the barriers that must be considered and the entry strategies that a company or a foreign independent professional can follow to be able to sell their services remotely in the US.

2. Exporting services to the US: general considerations

There are some aspects of exporting services to the US that should be taken into account:

- Unlike merchandise, tariffs and in many cases US sales tax do not apply to services.

- The US has an extremely unfavorable international balance of trade in goods (deficit of $887 billion) but very favorable in the case of services (surplus of $260 billion in 2018). This is one of the reasons why it has promoted progressive liberalization with the World Trade Organization (WTO) and in recent trade agreements to facilitate international trade in services.

- Since 1994 the general framework for international trade in services is the GATS or ‘General Agreement on Trade in Services’ of the WTO.

- Additionally, there are some trade agreements for specific areas such as the recent US – Mexico – Canada Agreement (USMCA) that since January 2020 replaces the old NAFTA. This agreement includes sections dedicated to the liberalization of services in critical sectors, such as the chapter on digital commerce.

- The European Union and the US have spent a decade negotiating a trade agreement, the TTIP (Transatlantic Trade and Investment Partnership), which has been essentially dead since April 2019 as a result of the change in trade policy initiated by the Trump Administration. This agreement is not expected to move forward until at least 2021 and this will depend largely on who wins the presidential elections in November this year. Until an agreement is finalized, service exchanges with the EU will follow GATS principles.

- In any case, according to the OECD Services Trade Restrictions Index (STRI), the US has an open and competitive business environment compared to the 45 countries included in the study, since foreign suppliers are allowed to compete equally in most sectors. The US is less restrictive than average in areas such as engineering, computer services, telecommunications, architecture, accounting, legal, and the film industry.

- An important point that should not be forgotten is that while international trade negotiations are handled by the federal government, states often regulate services, including licensing and certification requirements. Therefore, the applicable regulations of the states in which you want to offer services must be verified. Everyone must meet the commitments made by the federal government in international trade agreements.

- For Spanish-speaking countries it is always important to remember that the United States has the second largest Spanish-speaking community in the world after Mexico, with 58 million people. Hispanics are the largest minority.

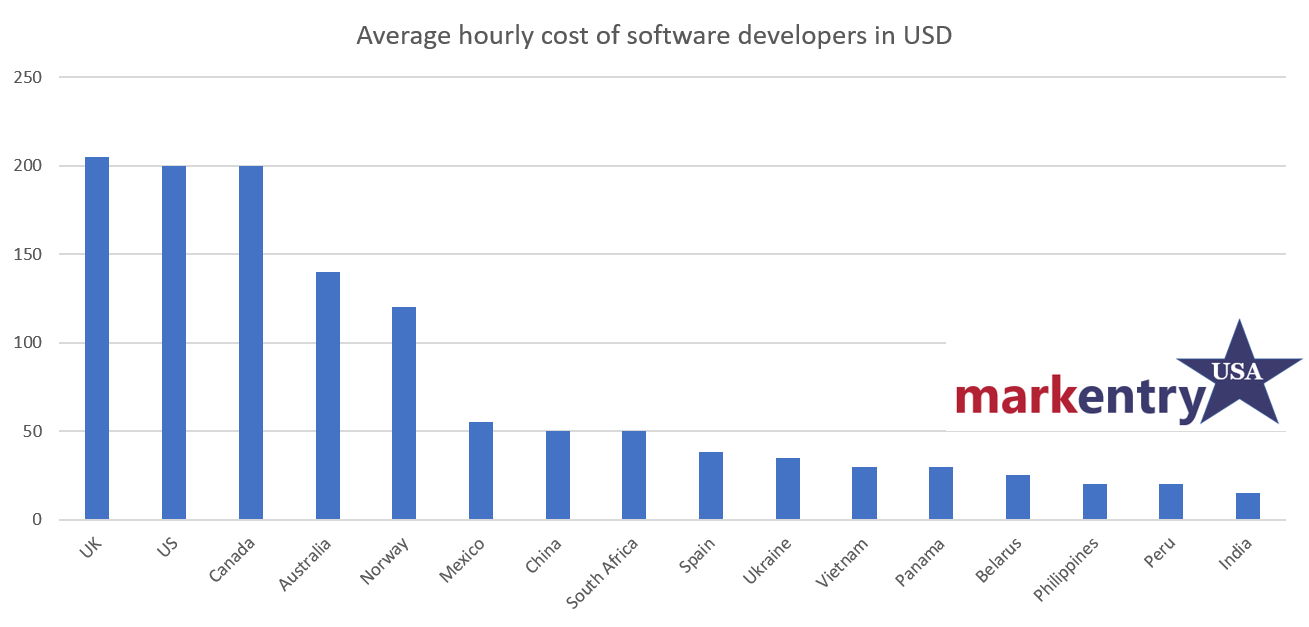

- The service cost differentials between the US and other countries can be very significant, as the following figure illustrates in the case of software developers (sources 1, 2 and 3). Obviously, the exact cost of a professional depends a lot on their level of experience and specialty, but the image gives us an idea of the huge gap found in some cases, since the US has a cost of more than 10 times that of India or 5 times that of Spain. Cost is never the only factor in a service outsourcing decision, but it can certainly be a significant competitive advantage.

3. Opportunities created by COVID-19

Albert Einstein used to say…

As we already explained in a recent post, without denying the enormous social and economic damage caused by COVID-19, interesting business opportunities have also been created. We discuss below some of the factors that favor the provision of remote services to the US from abroad:

- The high growth in unemployment (which has gone from 3.5% to 17.4% in a month) is highly concentrated in certain economic activities, many of which are not linked to remote services. In addition, the index that has just been published in May is 13.3%, 2.5 million jobs have been created in the last month, which could confirm the optimism shown in the US stock market that has already recovered a large percentage of what was lost in March.

- In the technological sector, unemployment has decreased this year, going from 3% to 2.8% in April (ref Forbes).

- Since March 20 visa processing has been suspended in all US embassies and consulates worldwide, with very few exceptions such as medical personnel and essential temporary workers. In addition, on April 22, Trump suspended for 60 days the entry of new immigrants with permanent residence (‘Green Card’). All this has been an insurmountable obstacle to attracting the flow of global talent to the United States, which is the second most competitive country in the world in this regard (ref GTCI) and has depended on it for the growth of its economy in recent decades.

- A 25% drop in the number of international students attending US universities is expected next year (ref New York Times). Causes include the suspension of visas, current travel bans and the risk that a good part of the next academic year may have to be followed remotely. This is a medium-term problem for sectors that regularly hire young foreign graduates.

- Given the risks of participating in face-to-face meetings and domestic travel, and the travel ban imposed on travel to the US for residents of certain countries (China, Iran, European countries in the Schengen area, the United Kingdom, Ireland and Brazil) the market has accepted as standard the provision of remote services whenever possible.

- The drop in sales has increased the pressure on company budgets, motivating the search of services at a lower cost using a global talent base, widely available in countries that are also experiencing a drop in production and unemployment much higher than the US. For example, it is estimated that the fall in production in the US by 2020 will be 3 points less than in the European Union (ref McKinsey).

4. Barriers to entry

“The obstacle is the way”

Marcus Aurelius

The American market is as open as it is competitive. It is essential to be aware of the multiple barriers to entry before thinking about providing remote services in this country. Some examples:

- Language: For service providers whose native language is not English, this is certainly a crucial aspect. In other parts of the world, the tolerance for errors in the use of this language is much higher, but in the US, with a huge internal market and a low level of knowledge of other languages (only 25% of the US population are polyglots), complete mastery is required. Mistakes in the first iterations can end any business opportunity.

- Culture: Beyond the language, it is difficult to sell in this country without adapting to the local culture, particularly regarding the way of doing business and the dynamics of human relations. Small nuances can be of great importance and create unexpected misunderstandings.

- Legal aspects: Although the complexity of the process to create a local company or provide services from a foreign entity is much lower than in most of the rest of the world, it is important to know the applicable federal, state and local laws, which could lead to surprises in the entry process or create unnecessary risks if homework is not done properly.

- Bank accounts: The availability of accounts in the US is not essential, but it will facilitate transactions with local clients and partners. In order for a foreign entity to open a bank account in the US, it must first create a local company in this country, since it will need to provide the associated information during the process. There are different types of companies that can be created, the costs and complexities are different in each case, but in general terms the process is much simpler and cheaper than in other countries. With a few exceptions, banks require an in-person visit to a branch in order to open an account. A non-resident person can create a bank account, but must provide much more documentation than a resident, which significantly lengthens the process.

- Professional Certifications: The services provided by some professionals, such as lawyers, doctors, structural engineers, financial advisors, accountants and others, are highly regulated and require obtaining a US professional certification or license, which is usually specific to each state. This does not apply to all services and is not an insurmountable obstacle, but it limits the possibilities and sometimes forces you to rely on local partners, defining a strategy that allows the use of foreign resources.

- Obstacles in the use of restricted technology: In sectors such as defense and in the aerospace industry, it is necessary to know in detail the restrictions of laws such as ITAR (International Traffic in Arms Regulation) that limits the export of information and dual-use technology which could be used against US national security interests. In classified defense contracts the restrictions are even greater. In both cases, there are ways for foreign companies to participate, although the process is complex and must be carefully planned.

- Government Contracts: The US government is the largest customer in the world, with a budget of about $350 billion for external services (ref GAO). The volume of service contracts awarded by states and local governments is also significant. In all cases and with very few exceptions, the existence of a legal entity in the USA is necessary to be able to compete for those contracts. Sometimes there may be restrictions on subcontracting to foreign entities.

- Time difference: Logically, it will be necessary to have enough flexibility to adapt to the local time of the final client for some activities, which can be complicated in certain services but is not generally insurmountable.

- Currency exchange: More than a barrier, it is a risk (due to unpredictable changes in exchange rates) and a cost (due to the rates associated with currency exchanges and international transfers). It can be adequately controlled with careful management and the use of financial derivative products.

- Taxes: They are not an obstacle but can represent an additional cost compared to local clients, especially if the company or the professional providing the services does not reside in one of the countries that have an agreement with the United States to avoid double taxation.

5. Entry strategies for companies

In 2017 (last year for which there is data), foreign-owned companies sold more than a trillion dollars (European billion) in services in the US through their subsidiaries located in this country. 52.2% of sales correspond to companies from the EU or the United Kingdom (ref CRS). In a significant number of cases, the US subsidiaries of these companies bill more than half of the group total.

Although in principle it is possible to provide services to US clients from a foreign company, to be successful in general it is essential to obtain local support in one of the following ways:

- Use of a local agent to support the process of promoting the company’s services, ensuring the definition of an appropriate strategy and the effective adaptation of its marketing, making presentations to potential clients.

- Creation of a US subsidiary. There are different types that can be considered (C-Corp, LLC, partnership) and the state of establishment of the entity and the location of the main operations must be decided (they can be different). It is possible to create the company with minimal cost and complexity and without having local employees, providing greater potential for business growth in the US.

- Establishment of a ‘joint venture’ or temporary strategic alliance with a local company that allows the creation of a beneficial relationship for both parties.

- Acquisition of a local company that provides the resources and sales channels necessary for rapid entry. A priori, it is the route of higher cost and risk, but it can achieve a greater impact in less time.

Which is the best option will greatly depend on the characteristics of the company and the target sector, it must be chosen through a careful feasibility study and proper strategic planning.

6. Entry strategies for freelancers

The changes in work relations in recent decades have been profound. According to a 2019 study (ref Forbes):

35% of US workers are ‘freelancers’

In recent years, there has been an explosion of collaboration platforms for freelancers that make it easy to find talent around the world at competitive prices. This allows experts from other countries to easily sell their services to US companies.

Platforms like Fiverr, UpWork, Freelancer.com, Skyword, SimplyHired and many others make it possible. In all cases, not surprisingly, these companies keep a portion of the turnover obtained, which can reach 20% but usually decreases to lower percentages as the volume per customer increases.

A priori, it is perfectly possible for a professional from anywhere in the world to offer their services through this channel. However, unless the US market is well known, when entering these platforms it is essential to define a thoughtful strategy with specialized local support. This will create the best possible impression for potential customers, ensuring that the English is impeccable, that the points of sale presented are adequate in the US market and that it is perceived as a highly professional and reliable offer. It may also be important to have such support in the first commercial bids. Achieving a solid start with high customer satisfaction is a must to build the excellent reputation that will lead to a continuous workflow.

These platforms can provide immediate market access, but are not suitable for highly qualified professionals who have developed or are able to develop their personal brand. In this case, it is advisable to establish an online presence and carry out the direct sale of services in the US with the necessary local support, to adapt the message, obtaining valuable contacts and choosing the appropriate channels, in order to maximize the chances of success.

7. Added value derived from the sale of services in the US

When considering the possibility of selling remote services in the US, it is easy to feel overwhelmed by the challenge, associated costs and difficulties encountered along the way. Therefore, it is especially important to keep in mind, in addition to the obvious economic incentive to succeed in the world’s largest economy, the resulting indirect benefits, among which we can mention the following:

- The US is a springboard to the rest of the world. In most sectors, the best introduction that can be provided in any other market is having developed strong relationships with US customers, especially when they are recognized brands, something that will completely change the perception of customers around the world.

- For companies, the sale of remote services is a low-cost entry gateway that can be used to probe the land before a complete landing in this market, which could entail as the establishment of a local team, the sale of products or even production in this country. It will provide the relationships and knowledge needed to tackle bigger challenges.

- Likewise, this local spearhead, even if it is based on remote services, will facilitate access to US human and financial resources that can drive business growth in later phases.

- For independent professionals who are interested in working in the United States at some point, the provision of remote services to American companies will allow the creation of relationships and references that will be essential before they can apply for a work visa.

8. Conclusions

The highly open and dynamic characteristics of the US market and its culture greatly facilitate entry for qualified foreign service providers from many sectors. The cataclysm caused by COVID-19 has created enormous problems, but it has also given rise to indisputable opportunities and modifications in labor relations that favor the use of remote services provided by foreign companies and professionals.

The incentive to succeed in this country is immense and therefore the level of competition is extreme.

To be successful, a deep understanding of the characteristics of the target market, an adaptation of the marketing, and the definition and implementation of the appropriate strategy will be required

For all this, the use of a local partner like Markentry USA who can provide specialized custom services can be crucial.

Share this:

- Click to share on LinkedIn (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to print (Opens in new window)

- Click to share on WhatsApp (Opens in new window)